Want to help your older kids learn essential money and life skills? Beyond Personal Finance Tween is a smart way to do it!

I knew that I needed an open-and-go approach to helping my youngest get a strong introduction to money management and decision making skills. After homeschooling his four older brothers (and seeing the value in having skills like budgeting, spending, donating, and investing skills), I looked for an interactive and budget-friendly curriculum.

I’m sharing our experiences with this financial literacy curriculum and how this program empowers tweens and beyond!

Disclaimer: I received this product for free and was compensated for my time. As always, I’m providing my honest opinions and was not required to provide a positive review.

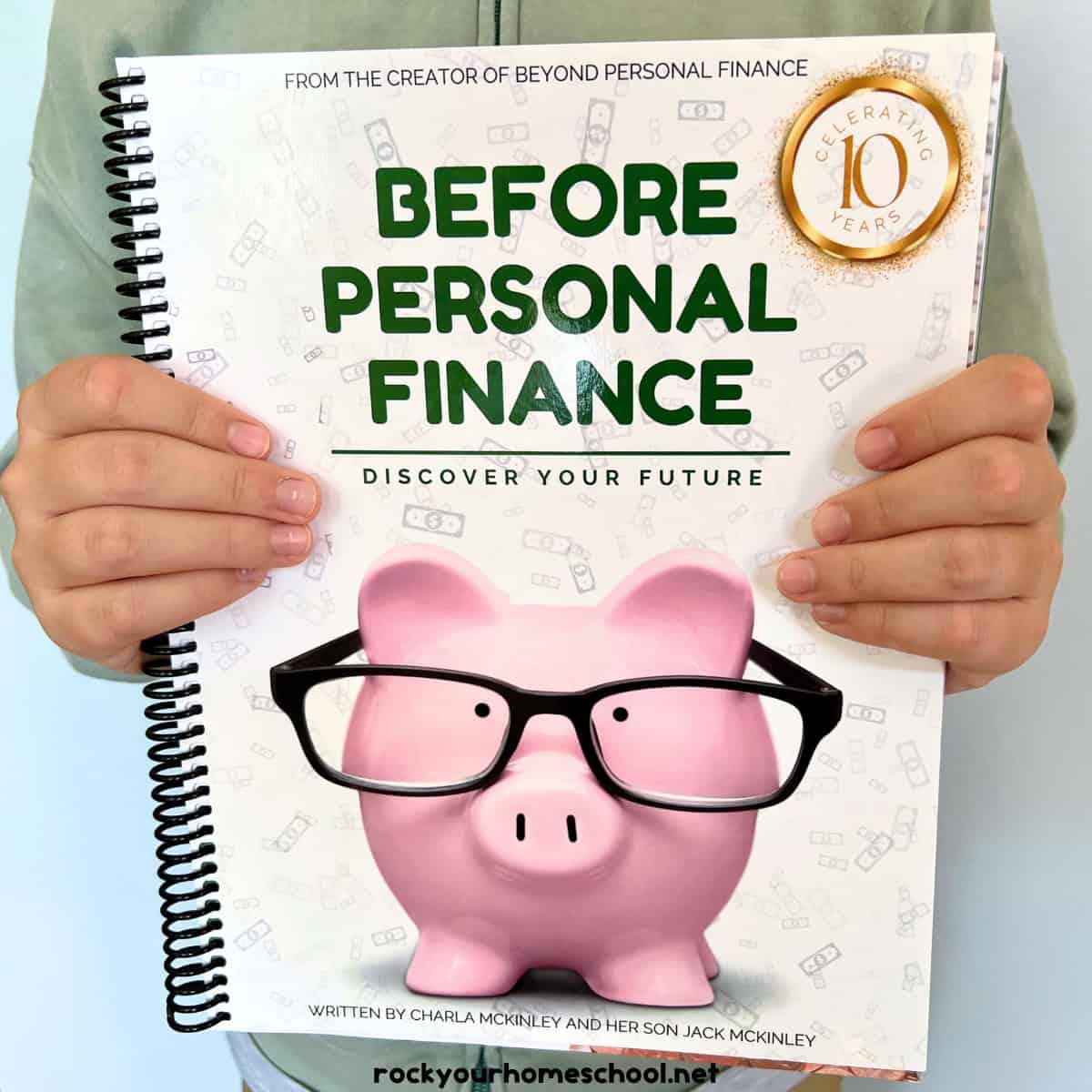

I’m sharing our experiences with Before Personal Finance (a new introductory course for tweens to learn to financial literacy) from the makers of Beyond Personal Finance. Thank you so much for reading our review and please let me know if you have any questions about this program!

Helping Tweens Understand The Value of Money

“Hey mom! Can I get a new Lego set?”

If I had a nickel for every time one of my boys asked me this question…well, I’d be able to buy them a big Lego set!

When Xman (my youngest – now 10) recently asked me this question, I made me stop in my tracks. It felt like he just got a new set featuring Super Mario. Yes, he did – for his birthday in March – and he quickly completed the over 2,000 piece set!

That large set was not cheap. In fact, it was his only birthday present because that’s all he wanted. Xman prefers quality over quantity 😉

As much as I want to nurture my boys’ interests, mama has a budget! I decided to use this simple question as a launchpad for learning money and decision making skills. We had a nice chat about his question and desire for more building blocks.

I didn’t grow up with a ton of money (and certainly don’t have a ton now!) but never felt deprived. I watched my grandparents and parents work hard, save, and do the best they could. I’m so appreciative of the strong work ethic they instilled in me. Of course, I want to do the same for my boys.

I realized that a more structured approach to personal finance for kids would help me teach him these essential skills. I discovered Beyond Personal Finance Tween (8-12) Curriculum and knew that it would be a fantastic fit!

Why An Early Start to Personal Finance Is Important

Money can be a sensitive topic depending on your background. It can be a difficult thing to discuss, especially if you’ve had negative experiences from your childhood or other times in your life.

I think it’s helpful to get an early start to learning and practicing personal finance skills. I encourage you to keep the following benefits of financial literacy in mind, whether you struggle with talking about money or not. These benefits can empower your kids (and you) to:

- Work smarter, not harder

- Avoid financial pitfalls

- Manage (or avoid) debt

- Practice growth mindset skills (like increased self-awareness and delayed gratification by saving)

- Set realistic goals and challenges

- Feel motivated with academic work

- Choose an educational and career path that fits their goals

- Practice generosity and donate to meaningful causes

All About Beyond Personal Finance Tween Curriculum

Before Personal Finance was created by Charla McKinley and her son, Jack. This curriculum was inspired by Charla’s Beyond Personal Finance Tween curriculum (for ages 13+). Jack felt called to introduce younger kids “to the world of smart money choices”.

This course has both a print text and online lesson resources for you to access. We primarily used the sprial-bound color workbook (150 pages). The workbook is open-and-go. The only prep work that you may need to do is preview the lesson to become familiar with the material.

This financial literacy program is designed to be used with ages 8-12. If you have students at the younger range, you may need to provide more support. I read through the materials with Xman (10) and he was able to independently complete most activities.

There are 10 lessons, including an introduction to money. As your student goes through the workbook, they envision their “Future You”, an avatar that will make choices and a budget to map out their financial life. Your tween is given real-life examples and activities to solidify covered concepts in these lessons:

- Introduction to Money

- Budgeting

- Earning Money

- Smart Spending

- Generosity

- Borrowing Money

- Governments & Money

- Bandks

- Investing

- Insurance

⭐ Watch this video to hear Jack McKinley explain how Before Personal Finance for Tweens works!

To better reflect the real world, your student will spin The Plot Twist Wheel (part of the online Teacher Resource page) where they discover if they lose or gain money according to the random scenario that displays.

Each lesson concludes with:

- People Who Have Made A Difference page that provides information about an important figure who influenced the world of money. A few of the individuals highlighted include Alexander Hamilton, Adam Smith, and Warren Buffet.

- Short quiz (with 10 multiple choice questions)

- Reflect page (5 prompts to encourage your student to record their thoughts and feelings about the lesson)

The final section of the workbook contains Key Terms (vocabulary). Very helpful reference and for review!

⭐ Take a peak inside Before Personal Finance with this interactive flipbook!

Our Experiences with Before Personal Finance

Xman and I have found the lessons to be straight-forward and engaging. The layout of the workbook is inviting and easy to navigate.

In the Lesson Overview (at the beginning of the workbook), teaching time is estimated to take approximately 30 minutes. I would say to allow for that amount of time with younger students.

We chose to extend the lessons over a few days. With other subjects and curriculum, Xman has had the best success with this approach. So far, he’s completed about one lesson a week (which includes review to make sure that he fully understands the material). If it better fits your schedule, you could do one lesson a day.

“Mom, when are we going to do my money lesson?” When Xman asks to do a homeschool subject, I know that he’s enjoying the material!

We both got a big kick out of the budgeting activity in Lesson One. Xman’s Future You (age 13) had $300 plus $150 (from “an awesome plot twist – I get that much money for shoveling snow!). With $450 to work with, his options for spending and giving included:

- Snacks! = $100 (for snacks or candy every time you visit a store)

- Wheels! = $250 (for a new bike)

- Gear! = $90 (for sports gear)

- Books! = $50

- Lessons! = $70 (to improve skills at a sport, hobby, or passion)

- Bricks! = $80

Well, we just laughed out loud at that last option! Xman jumped at the chance “for Legos for $80 bucks – oh yeah!!”. I thought it was cool how that option circled back around to my whole reason for looking for this incredible financial literacy curriculum!

As a busy homeschool mom, I love how I have no prep work for Beyond Personal Finance Tween. Plus, I tend to overcomplicate matters when it comes to talking about money with my boys. I greatly appreciate how this curriculum simplifies the concepts and make them easy to talk about and understand.

I believe the price of this curriculum ($40) is very affordable. The powerful resources that help you teach your tweens lifelong skills about money and decision making is priceless!

Empower Your Tweens with These Essential Life Skills

If you’re looking for an effective way to help your student between the ages of 8-12 get a smart start to money management, Beyond Personal Finance Tween is a fantastic choice.

I encourage you to pop over to Beyond Personal Finance to learn all about this personal finance curriculum for tweens (and take a peek at that flipbook!) for only $40. Get this curriculum and discover for yourself all the amazing lifelong lessons that your tween will benefit from and enjoy!