It can be easy to teach kids about money – when you have the right program.

MoneyTime Kids has been a huge success with my boys. This online financial literacy program has a real-life approach that’s also fun.

Find out how we’re using MoneyTime Kids to help rock our homeschool and teach these essential life skills.

Disclaimer: I received this product for free and was compensated for my time. As always, I’m sharing my honest opinions and was not required to provide a positive review.

Interest and Savings and Investing – Oh My!

If the thought of how to teach kids about money feels overwhelming, you’re definitely not alone.

Simple money concepts – like identifying dollars and coins, even making change – can be lots of fun with hands-on activities and practice.

But, how do you help kids learn higher-level essential money management skills?

I find myself considering these questions more and more as my boys get older. Now that my oldest has graduated homeschool high school and entering a trade, I wish that I would have got an earlier start on teaching him about finances and such.

As I play catch up with my oldest on financial literacy, I’m taking steps to help my younger boys learn all about it.

I did not, however, have a clue about how to teach kids about finances. Like, how do you break down those concepts in easy-to-understand ways?

So, I started searching for fun and effective ways to help my boys learn these important life skills.

After finding a few cool options, my boys and I went with MoneyTime Kids. Read on to find out why we chose this online financial literacy program.

Give Your Kids a Boost with Money Management Skills

As I learned through our experiences and research, it’s never really too early to teach kids about money.

After your kids have learned the basics (like identifying coins and making change), keep going! Build on that knowledge and take it to the next level.

I wish I would have had more exposure and lessons about finances. When I got to college, I was clueless. Living hours away from home, I had to sift through a bunch of information about credit cards, interest, and keeping enough money in my checking account to cover my living expsense.

I figured it out but it added to the stress of trying to adjust to life away from home for the first time.

I’d like to help my boys avoid that kind of stress – and get a smart start to money management 😉

Teaching our kids important life skills can boost their chance of success and overall happiness.

A solid knowledge base of finances can have a huge impact on career and family life. Plus, if your kids get a strong start to managing their money now, they’ll be able to make smart decisions as teens and beyond.

You CAN Teach Kids About Money – & Make It Fun!

To be honest, my eyes used to glaze over whenever financial stuff was brought up. Money talk just never really grabbed my interest.

But, I didn’t want my negative experiences to get in the way of effectively teaching my boys about finances.

When I looked for an online financial literacy program for my younger boys, I knew that we’d want:

- Engaging (no boring stories!)

- Interactive

- Fun

- Self-paced

- Independent (I can’t always be sitting right there at the computer with them)

- Real-life (fictional stories are great and all but my boys better grasps concepts like skills with real-life scenarios and activities)

With MoneyTime Kids, I can check off all those boxes and then some!

MoneyTime Kids: Fun & Effective Financial Program

This online financial literacy program for kids ages 10-14 is packed with goodies!

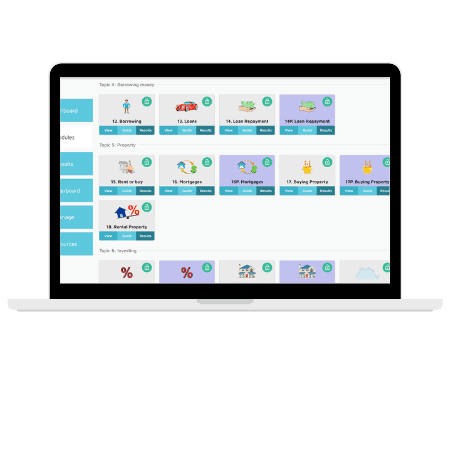

MoneyTime Kids has 43 self-paced learning modules (lessons).

There are 30 personal finance lessons for kids to independently work on. And there are 13 optional Parent-Child lessons that make it super simple to chat with your kids about these concepts and how to apply them in their lives.

Each module takes about 20 minutes – and that includes the interactive game.

Your kids take pre- and post-module quizzes to test what they’ve learned.

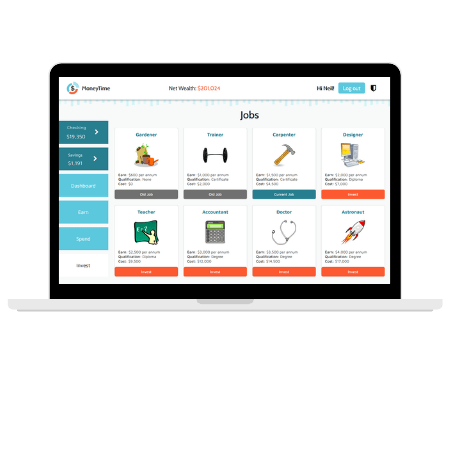

For each correct answer, your kids earn virtual money that they get to choose how to spend on things like:

- extras for their avatar

- investing in higher education

- property

- stocks

- donating to charity

- other investments

As your kids spend the virtual money that they earned, they experience how those financial decisions affect their overall net wealth.

MoneyTime Kids modules effectively cover a range of financial concepts like:

That’s a whole lot of money management skills for kids!

In addition to earning virtual money for correctly answering quiz questions, your kids get to earn Achievements, like Grit Reward and Money Maestro, when completing special tasks.

Each module builds on previous modules in a special sequence to encourage mastery.

MoneyTime Kids has been a fantastic addition to our homeschool. (Learn more about why it’s perfect for homeschooling HERE.) It’s unbelievable how much my boys have learned using this program!

One thing to note: MoneyTime is online, it is not compatible with mobile phones and it is NOT an app. MoneyTime can be used on any laptop, desktop, or tablet that connects to the internet.

Give Your Kids the Gift of Financial Literacy

WooHoo! You’re on your way to providing your kids with excellent money management skills.

You can check out all that MoneyTime Kids has to offer by clicking HERE.

MoneyTime Kids has 2 cool payment options:

- Monthly subscription for $12.95 (with additional children for $9.70/month) – with NO minimum contract (cancel at any time)

- Annual membership for $66 ($5.50/month – with additional children for $49.50 each) – one-time payment with no re-occurring billing and 60-day money-back guarantee)

The 25% off isn’t working.

Let me check on that! I’ll update when I find out 🙂